“This young fintech startup is playing a big role in risk management for the financial services industry.” — BusinessToday.in

Any guesses which fintech startup is getting referred to here? You would know if you read the blog’s title before coming here.

It is Karza Technology.

Snapshot

Mumbai-based Karza Technologies is an analytics, business intelligence, and automation platform that aggregates and analyses information to provide onboarding, due diligence, monitoring, and skip tracing solutions for the BFSI sector. With its state-of-the-art automation capabilities, the firm has acquired a diverse portfolio of 330+ live clients, spanning many use cases in the industry.

Karza was recently in the news when it got acquired by Perfios (backed by Warburg Pincus) for $80m. Karza’s vision to become the ‘single source of truth’ for all businesses strengthens Perfios’ lending-focussed product offerings.

The beginning of a partnership

Artha’s journey of partnering with Karza started in mid-2017 when the Company had just ₹4.2 lakhs (FY 2017) in revenue and was far from realizing its true potential.

The Karza founders met us through Hardik, a member of the Funder’s Circle, a community of superangel investors that meets every 4-to 6 weeks to share their investment experiences. Hardik later went on to join Karza as their Head of Strategy & Investor Relations. All three co-founders had diverse backgrounds, and each of them bought a unique set of skills to Karza:

- Omkar Shirhatti (CEO): A CA who worked in the Fraud Investigation and Dispute Services of Ernst & Young LLP for over 3.5 years, where he was part of multiple corporate fraud investigations.

- Gaurav Samdaria (COO): A CA, CFA, FRM, and CS with over 4.5 years of experience and had worked in the startup ecosystem when he was a co-founder in Schbang and CFO of FoxyMoron.

- Alok Kumar (CTO): A master’s in technology from IIT Kharagpur with a focus on Data Science and had over 3 years of experience with the Data Science team of Morgan Stanley, specializing in fraud analytics and natural language processing.

aD’s take

The pitch: Omkar and Gaurav’s pitch caught my immediate attention. Instead of explaining the size of the market or the speed of their technology, they chose to wow us with a live demonstration. The underwriting head of a leading bank tasked them with background verification of a company that had applied for a sizeable loan. Looking at what they delivered in return, I fell hook, line, and sinker as an investor.

Gaurav and Omkar showcased a chart that they had shared with the bank. It reminded me of those complex chemistry models that I would cringe to build in school. The only difference now was that this chart did not have elements from the periodic table. Instead, they were a cloud of shell companies that hid the Company’s true owner seeking a loan. The ultimate beneficiary was a business house renowned for creating NPAs and defrauding banks. The bank became a customer, and Artha became an investor!

Growing demand — Investing in Karza matched our thematic preference for consumer lending as articulated by Anirudh, “Consumer lending is under-penetrated in our country, and the more we have platforms that the consumers can lend from, it makes the pile bigger. At present, lending at an enterprise level is taken care of, but the rest suffer from a cumbersome process. Debt is an important piece in creating wealth.”

The following table reflects the above statement showing the overall growth in loan originations from 2017 to 2021, and reiterates the demand for credit in the economy:

Additionally, our market sizing study in 2019 which was released before our investing in the pre-series A round, reinforced our belief in the defensibility and scalability of Karza’s business model. The research indicated that India was home to 1,263 digital lending startups, out of which ~12% were VC funded, with funding growth for B2B lenders at a CAGR of 72.0% (2015–2019). Karza was well placed in the ecosystem to take advantage of the lending ecosystem growth as an integral infrastructure provider.

Inefficient manual issuance process — We are often told to learn from our mistakes and make better choices. Karza was our “better choice” as we experienced that while applying for commercial loans, the credit risk assessment was not data-driven. The manual nature of the issuance process made the experience highly time-consuming.

The government’s success with the 59 minutes Public Sector Banks (PSB) loan scheme was evidence of the success of Karza’s business model.

Increase in fraud — Finally, the increase in the number of fraud cases and the total value of scams reported to the RBI clearly show a need for Karza’s fraud prevention focus in the following charts:

As per RBI, there were frauds of ~₹400bn in FY2018, and it has only grown since to ~₹1,384bn in 2021.

The following agenda set by RBI to reduce fraud in banks also points to the solutions that Karza provides:

- Strengthening the on-site assessment of oversight and assurance functions, including risk and compliance culture

- Adoption of innovative and scalable SupTech (Supervisory technology) to enhance the efficiency and efficacy of supervisory processes by modifying their capacity and capability

- Streamlining the process of data collection from all the banks and their off-site assessment and on-site supervision of select banks based on the outcome of a risk-based model developed for KYC/AML supervision

- Enhancement of Fraud Risk Management System includes improving the efficacy of the Early Warning Signal (EWS) framework, strengthening fraud governance and response system, augmenting the data analysis for monitoring of transactions, introducing of dedicated market intelligence (MI) unit for frauds and implementing of unique automated system generated number for each fraud.

Karza’s technology to prevent fraud has been efficient from an exceedingly early stage, as demonstrated by Gaurav & Omkar during their pitch.

The under-penetrated lending, cumbersome onboarding processes, and a growing need for fraud prevention made our investment in Karza highly defensible.

Risks involved in investing

Investing in Karza was not without taking on risks. Our primary concerns were

High Operating Expenses — As a B2B SaaS company, high operating expenses, long-tail sales cycles, and high dependency on a few contracts were natural. However, we saw that Omkar & Gaurav were naturally thrifty spenders and were not comfortable with long-term cash burns. Secondly, their customer billings started small but grew significantly and rapidly as the customers realized the actual value of their offering & readily bought their new add-on features. These two observations made us comfortable to back a deep-tech financial services provider.

Competition — Additionally, Karza competed with major corporations like EY, Deloitte, Oracle, CRIF, CIBIL, and Experian (as illustrated below). While none of these behemoths focused on providing online services to banks, they had long-standing relationships. They were well entrenched as go-to providers for verification, technology needs, and borrower assessment, so breaking into this ecosystem required high trust from clients, given the sensitivity of the consumer data.

An important thing to keep in mind was the founder’s attitude & commitment to building a Karza-type play in 2017. A founding team with a cavalier attitude to data protection can upset already cautious institutions dealing with startups. Besides, most large institutions conduct their due diligence on the Company, including looking into the founder’s background. If a founder had a questionable history or quit, it could destroy the Company’s credibility, which is almost impossible to recover from in the financial world. However, during our due diligence, we found that the founders were supremely concerned with their data security. Still, they also had a lot of faith & respect for each other abilities & responsibilities.

Besides, coming from 2 strong references of Hardik and Narendraji Karnavat, we were confident that the risks we had identified got adequately priced into the Company’s valuation.

Post investment growth

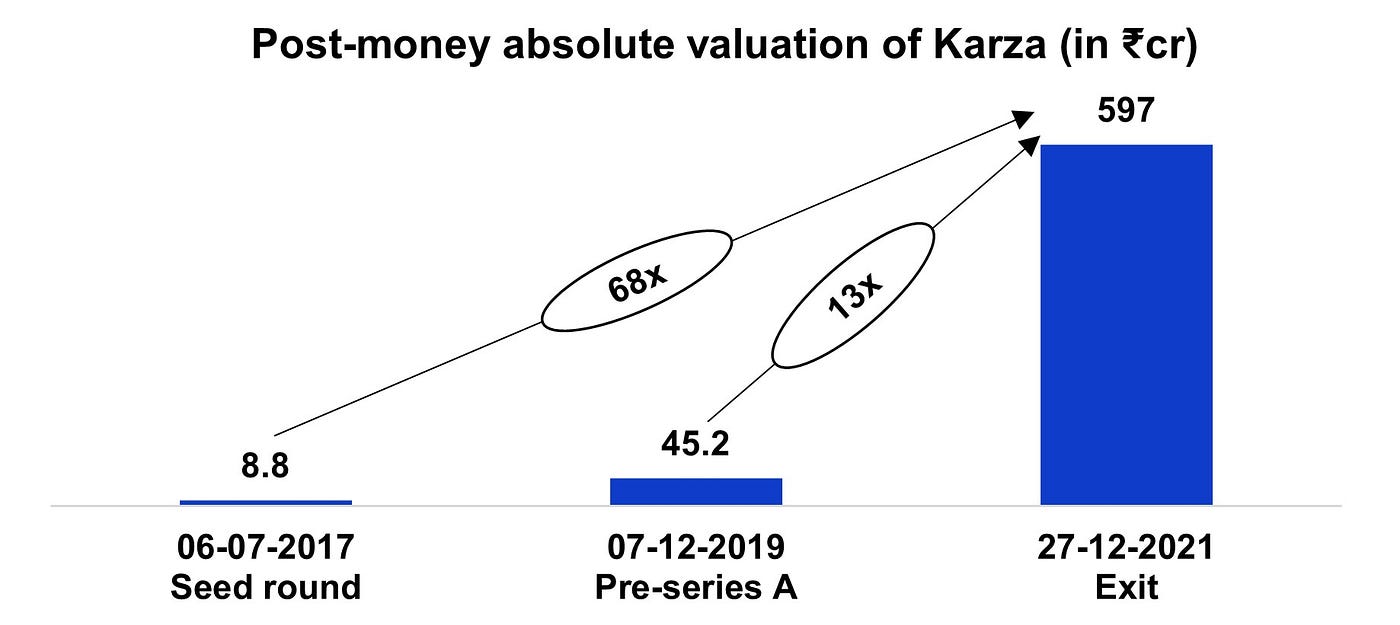

Artha India Ventures invested Karza in the seed round raised in July 2017 and the Pre-series A round raised in December 2019 at pre-money valuations of ₹6.3cr and ₹40.2cr, respectively. The following graph shows the growth in the absolute valuation of the Company:

We were the biggest cheque in the seed round and invested super pro-rata in the Pre-Series A, but more significantly, we wanted to be partners and not just finance providers. We were deeply invested in the vision and mission of the Karza because when asked what investors bring to the table other than money, “Network would expect investors to open more doors and expand horizons.”

At Artha, we attempted precisely that by leveraging our existing portfolio ecosystem like LenDenClub to Karza so that both companies would benefit symbiotically. We helped the Company connect with banks and new-age fintech platforms.

A critical help we provided (but was not envisioned by either side) was customer reference checks on the founders during the earlier stages of their growth.

aD’s take

I was meeting the family office from one of India’s more prominent family offices while raising for AVF’s 1st fund. I found it odd that the family office team & family office head spent an excessive amount of time investigating our investment in Karza and the founders’ background. In the closing stages of that meeting, they mentioned that Karza was doing a fantastic job for an NBFC where the family held a significant stake. Getting unsolicited positive customer feedback and a reference check reminded me of the importance of choosing the right investors at the earliest stages of venture building. Especially for a sensitive data handling venture like Karza!

Besides, Karza proved the importance of investment in superior technology. It can lead to disproportionate scale because of operating leverage, which may take time to show results, and the profitability is remarkably high once demonstrated. At the time of exit, Karza had generated revenue of ₹33.4cr in FY2021, representing a CAGR of 430% from FY2017 which can be partially attributed to the increased need for digitization due to COVID-19 induced lockdowns, which shortened the timeline for digitization. It also shows that doing the right things diligently and consistently even when no one is watching helps capitalize when the tide finally comes in your part of the bay!

Network effects created by good relationships and continued accurate operations can become the moat for companies like Karza and lead to value accretion evident in the 13.0x jump in valuation in ~2 years with annual marketing spend of just ₹50 lakhs.

Another of Artha’s portfolio companies following a similar trajectory was Exotel, a full-stack customer engagement platform comprised of a suite of communication APIs, an omnichannel contact center, and a conversational AI platform in the cloud. It is also a B2B business that capitalized on superior tech, solid relationships, and trust built due to consistent outperformance of competition. As a result, it raised $40mn in Series D financing at a post-money valuation of ~$307mn.

Along with the financial success of Karza, it is also important to note that it has been successful in achieving its mission and was able to cut onboarding times by at least 70% over the past five years, and has prevented $350.0mn in fraud by weeding out fraudulent applications at the outset.

The exit

COVID19-led business disruptions were a massive enabler for Karza’s business.

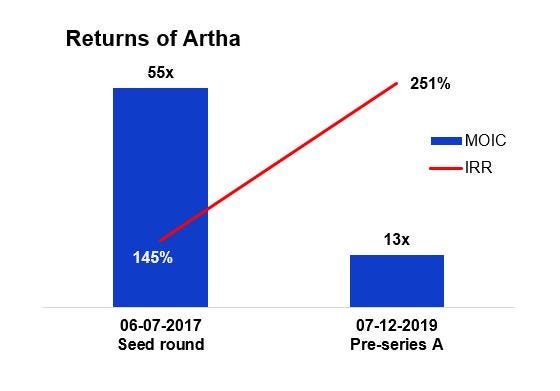

Given its exemplary performance over an abbreviated period, it was not a surprise when Karza received a strategic acquisition offer for 100% of the Company. Our exit at a MOIC of ~55x from our investment in the seed round represents an IRR of 145%.

However, a big realization was the returns in the pre-series A round, i.e., the follow on — a MOIC of ~13x but an IRR of 251%.

The stellar returns from both rounds of exits validate our strategy to continue backing our startups that are leaders in their micro-industries. The earliest cheques carry the highest risk, but the stakes are significantly diminished in the follow-on rounds while providing higher returns.

While we have reaped the benefits of this strategy over the last 7 years through Artha India Ventures and Artha Venture Fund, we are now formalizing this thesis through new upcoming funds.

Conclusion

In conclusion, the quest started by the founders of Karza to digitize processes of financial institutions, reduce fraud and take on long-established players was a hard one. Still, they have managed to come this far through their continued diligence, regular improvements in the already superior tech, and a little support from investors.

Although the quest is not yet complete, the vision with which the Company started lives on. We believe that this leg has already been a great one, and we cannot wait to see what they will do in the future!

In 2019, Perfios acquired Noida-based FintechLabs Technologies, which provides digital lending software to banks, NBFCs, digital lenders, and financial institutions in India and overseas. The acquisition also makes sense because India’s overall fintech market opportunity is estimated to be $1.3tn by 2025, growing at a CAGR of 31.0% from 2021 to 2025 — lending tech is likely to account for 47.0% ($616.0bn). Besides, the market size for fintech SaaS in India should see a 2.7x surge in the next three years, from $4.6bn in 2022 to $12.6bn in 2025.

We invested right, honestly, and doubled down when the opportunity presented itself. Now that we have completed this journey, we cannot wait to continue scouting for more passionate and hardworking founders like those who led Karza Technologies!

aD speaks

Karza built the sort of business I love to invest in, i.e., they did not need the invested capital to get started or make ends meet. At most times, the investor capital was in treasury — as a backstop “in case” they had a bad quarter or two. However, Gaurav, Omkar, and Alok built such a strong business that it barely (if ever) needed to dip into the investor capital.

The enthusiasm for Karza within the seed investors was so high that its Pre-Series A round got oversubscribed by the initial investors despite a substantial offer from a significant investor. Karza-type exits remind us that build a beautiful, sustainable and profitable business, and you will be the darling of investors in all seasons!