Our first investment in Europe!

Remember when Disney acquired BAMTech for US$4.70b? It seemed like a move out of nowhere, right? Wrong.

Despite its deep pockets, Disney thought that acquiring a tech company would be better than having an in-house tech team in logistics and scale. “Our investment in BAMTech gives us the technology infrastructure we need to quickly scale and monetize our streaming capabilities at ESPN and across our company,” said Robert A. Iger, Chairman and Chief Executive Officer, The Walt Disney Company. It’s pretty evident that Disney, like many other media houses, have a common problem; they are not an engineering company and want to focus on creating content.

A recent report by media consulting firm, Ormax suggested that 46% of the audiences feel the technology of a platform, including video quality, is more important to them than the content itself. With media companies already competing for good quality content, tech should be the last thing they must fret about. Laminar hopes to assist such companies in focusing on what they do best by taking on the tech piece.

What is Laminar?

Laminar is a Platform as a Service (“PaaS”) provider that aims to revolutionize the D2C streaming media business. It is a pure B2B play that aims to equip media houses and content creators with the ability to distribute their content directly with no upfront Capital Expenditure (CapEx). The company provides its customers with a full-stack platform, including an end-to-end fully managed video asset pipeline, hybrid revenue models, customizable apps for all devices, and data-driven functionality.

Laminar has stitched together an exceptional team, superior-tech product, and a domain-specific ecosystem creating a 2-year moat against the competition. The company claims to have no real competitors offering the whole spectrum of services.

Bootstrapped and born in the pandemic, Laminar has an impressive ARR of $5 million+ and a current pipeline of $75 million+.

Laminar’s objectives got outlined in the simple words of Co-founder & Head of Growth, Raheel,

“OUR OBJECTIVE IS SIMPLE — TO LET CONTENT COMPANIES OR CREATORS DO WHAT THEY DO BEST: CREATE CONTENT AND DELIGHT AUDIENCES — WHILE WE MANAGE THE ENGINEERING AND INFRASTRUCTURE. THINK OF US AS THE AMAZON WEB SERVICES (AWS) OR WORDPRESS OF STREAMING.”,

Services Offered:

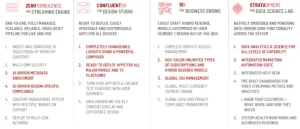

The company targets customers who own content rights and have consumers willing to pay for that content. They follow a model that has no upfront costs for the creators. Clients, through their content library, should be addressing a niche and have a paying audience of at least 100 thousand around the world. 4 integrated services offered by Laminar are: –

a) fully managed infrastructure for streaming,

b) localized apps for global scaling,

c) business engine managing data privacy, compliance, tax, and payments and

d) data analytics and an AI engine.

Each service is described in detail below:

Market Opportunity:

The video streaming media market is booming worldwide, as audiences worldwide are increasingly moving away from traditional modes of video consumption and switching to consuming video on a device of their choice, at a time of their choosing. Consumers prefer Over-the-top (OTT) platforms over traditional ones because of the following reasons:

- Reduced cost

- Crisp sound and picture quality

- Instant playback at a time and place of choice

- Multi-Platform and device service

- Original content

The pandemic gave a lot of free time to people. However, due to the reduced data-access costs, steep rise in online viewership, and increased adoption of OTT services, most digital media and broadcasting service businesses are increasing their efforts to build novel channels, enabling them to download different types of content on a multitude of devices.

Although OTT has gained popularity, operating an OTT platform necessitates the development of complicated technology by media businesses. The difficulty is that media firms are not tech companies; therefore, they must seek external help to launch on platforms like Netflix or Amazon or system aggregators such as Accenture and TCS. However, this technology is patched together, costly, and does not work globally. Laminar provides its clients with an end-to-end platform for them to cater to the growing needs of their audience without an in-house tech team and, therefore, in a capital-efficient manner.

Some significant developments in the market concerning its size and growth are as follows –

- The global over-the-top (OTT) market CAGR, as projected before the rise of the COVID-19 pandemic, was 16.7% from 2018 to 2026

- The global over-the-top (OTT) market CAGR, as projected post the rise of the COVID-19 pandemic, is anticipated to be 19.1%1 from 2018 to 2026

- The global over-the-top (OTT) market sector size in 2018 was $245 billion

- This market is expected to increase to $689 billion by 2024.

Competitive Analysis

The company has three sets of competitors: –

- The primary category would be media companies that want to set up their APIs and website launch kit without going to any third party. In that case, the competition will be companies like Accenture, TCS, and Wipro

- The second category would be third-party companies operating in the same space as Laminar. In this case, Laminar considers companies such as Brightcove and Kaltura as competition

- The third category would be streaming services like Netflix and Amazon Prime, where the media companies would earn on a “per view” basis or receive money as a lump sum

We believe that Laminar’s unique proposition is the need-to-have solution for the problems faced by the $250b+ streaming industry. Besides, Laminar is years ahead of the potential competition as it offers services today (listed below) that other platforms will have to work long & hard to emulate:

- A zero CapEx “pay-as-you-grow” model

- No requirement for an in-house tech team for their customers

- Ready to use customizable apps deployable across geographies, operating systems, devices

- No revenue share on incremental ad monetization opportunity

- Ready to use AI/BI platforms for customers

- An inbuilt data and privacy compliance management service, multi-currency accepting payment engines, and a global tax management platform.

Why did we invest in Laminar?

In February, Laminar raised $5.11 million in seed funding led by Leo Capital and Artha India Ventures. Laminar is our first investment in Europe and is the largest deal we have done via Angellist USA.

We invested in Laminar for the following reasons:

High defensibility: Laminar, with its unique proposition, is carving itself a niche in the OTT hosting sector. Laminar sees itself as a Shopify for content makers. It provides a platform for content creators to reach out to their fans utilizing Netflix-grade technology but with no capital outlay, no tech team, and a 6–12-week time to market.

Scalability: With the OTT industry expected to grow at a 19% CAGR over the next few years, experts expect an increasing number of small and mid-level media houses emerging in a fragmented manner, trying to create niche content requiring Netflix/Amazon-like technology. With OTT increasing their expenditure, Laminar has a direct benefit, which provides the intelligent infrastructure to media houses.

Ease of integration: Laminar’s plug-and-play service enables content providers to broadcast OTT while focusing on their core content production strength and outsourcing platform administration to Laminar.

Deep moat: Laminar has built a substantial moat by offering value-added services such as global tax administration, global privacy compliance, AI and data analytics services, and payment integrations inside the app.

Founding team:

What drew us to Laminar was its exceptionally well-balanced founding team, with decades of experience in media and video engineering with finance and B2B sales expertise.

· Narendra — Founder/CEO: The “geek/entrepreneur,”

- 20+ years of experience in media and technology.

- Helped launch TV channels and multiple digital offerings and led global digital transformation efforts in Asia and Europe at Mint, CNN IBN and Hindustan Times.

· Tirthraj — Founder/Head of Finance & Ops: The “Bayesian thinker.”

- Head of finance and operations

- 12+ years of experience leading strategy and high-efficiency programs at some of the world’s largest banks across global markets.

· Shanyang — Founder/Head Data & Engineering: The “map maker”

- Head of data science at Laminar

- 15+ years of experience building data and intelligence systems for “all kinds of customers worldwide.”

- Built maps to navigate complex landscapes for some of the world’s largest telecom companies.

· Raheel — Founder/Head of Growth: The “growth accelerator.”

- 12+ years of experience helping global tech firms grow exponentially.

- Helped launch some of the world’s most popular tech firms in some of the world’s toughest markets and comes with a robust global network.

· Shorav -Founder/Head Video Engineering: Head of engineering is the in-house “video geek.”

- 15+ years of experience building products across the media landscape.

- Built and scaled ZEE5, Zee Enterprise’s OTT offering, to 150 million monthly active users (MAU) across 190 countries.

Business model and Traction:

Laminar uses a Zero CapEx pay as you grow plan for its revenue model. The client agrees to pay a monthly fee based on the number of users/subscribers onboarded on the platform. Laminar’s subscription model has more straightforward payment terms for the clients of Laminar while creating a steady flow of revenues with 3–5-year lock-in contracts.

Laminar recently launched an OTT platform, Chaupal, with 400+ videos in three languages with region-specific content, UI and subscription models globally (across 110 countries) on all devices in 12 weeks. and have a deal for three years with minimum revenues of $4.80m per year. These offerings are a good value proposition as they offer a significant discount compared to most other video streaming platforms currently listed. In addition, the company recently bagged “Streaming Faith”, the world’s leading provider of Internet broadcast services to faith-based organizations, as their latest client.

Laminar also has exclusive agreements with clients with a mandatory 3-to-5-year lock-in period with a rollover extension. Deep integration into Laminar infrastructure creates stickiness with their clients allowing the team to focus on platform upgrades that elevate the end-user experience.

Being a high fixed cost business, the cost per user decreases substantially at scale. As a result, at scale, the company’s gross margins are expected to be 60% from the current 50% level.

Future:

Laminar aims to start by acquiring 1 customer/quarter to 1/month to eventually hitting 1/week, i.e., 50+ new customers/year.

We envision Laminar entering significant media hubs such as Asia, Africa, and Latin America and making the most of these opportunities. With the increase in streaming services and them being most of the traffic on the internet today, Laminar has vast market potential.

To conclude, in aD’s words,

“Laminar hit all 4 notes that we love to see in an investment. First, Laminar solves a pressing problem for a large set of clients. They offer this a price which gives the startup solid unit economics over a sustained period. In addition, they have a significant moat that will take quarters, if not years, for others to overcome while, most importantly — their technology is the enabler.

You add to those solid global revenues with a well-balanced team, and we have the type of investment that I will make even if Artha must move mountains to complete it!

Besides, we see Laminar as a stepping stone to doing more deals in media that are powered by Laminar!”